www.capitalwix.com

How does it WORK?

Capitalwix, Where Big Business and Bold Ideas Collide and Where Vision Meets Venture: Your Equity, Our Startups.

Opportunity, Innovation and Equity, All in One Place

At Capitalwix, we are your destination for opportunity, innovation, and equity—all brought together in one dynamic platform. Discover a world of investment potential where forward-thinking ideas meet financial growth.

Sign Up

Registration: Begin by creating an account on our platform. Provide your basic information, including your name, email, and password.

Profile Setup: Complete your user profile by adding details such as your investment preferences, risk tolerance, and financial information. This helps us tailor investment opportunities to your needs.

Browse Startups

Discover Opportunities: Explore a curated selection of startup investment opportunities. View detailed profiles of startups, including their business model, team, financials, and growth potential.

Filter and Sort: Use our filters and sorting options to narrow down your search and find startups that align with your investment goals and interests.

Invest

Make Your Decision: Once you’re confident in your choice, it’s time to invest. Choose the amount you want to invest and complete the necessary documentation.

Legal and Compliance: Our platform will guide you through the legal and compliance aspects of your investment, ensuring a smooth and secure transaction.

Monitor

Stay Informed: After you’ve invested, keep track of your portfolio through our user-friendly dashboard. Access real-time updates, performance metrics, and reports on your investments.

Support: We offer tools and resources to help you make informed decisions about your investments. Stay engaged with the startups you’ve backed.

Fueling Dreams, One Investment at a Time

Invest in different industries, markets, geographical regions or even technologies

- Asian & US Market

- Vehicle Industry

- Agriculture Industry

- Manufacturing Industry

- Insurance Industry

- Fintech & Banking

- and much more

Partnering for Profit: Your Equity, Our Expertise

150+

Investing Courses

90+

Total Startups

50+

Investing Reports

Portfolio of investments

Invest in different industries, markets, geographical regions or even technologies

- Artificial Intelligence

- Biotechnology

- Healthcare Industry

- SaaS and Software

- Cybersecurity

- Retail & Logistics

- and much more

Investing for Tomorrow's Success Today

Join us, and experience the convergence of innovation, opportunity, and equity, all in one place, to help you shape your financial future.

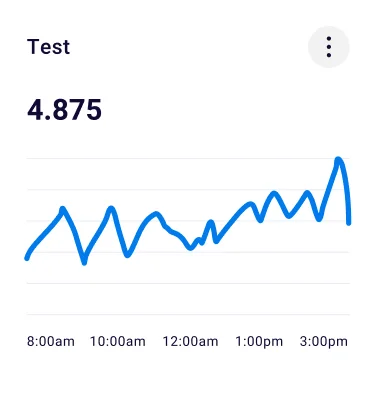

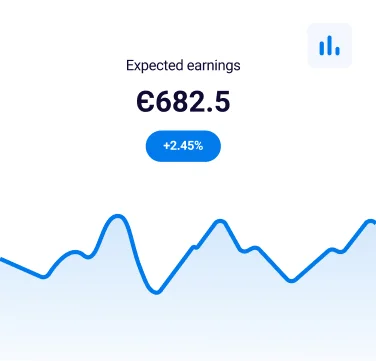

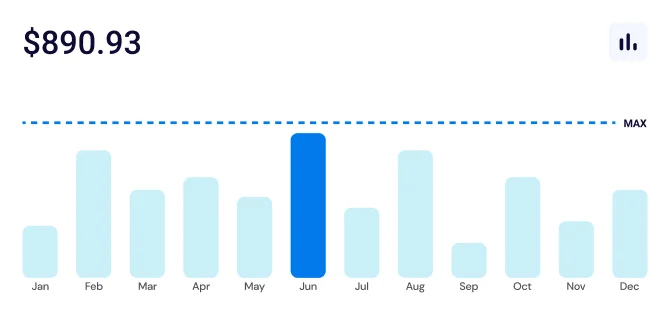

Smart Dashboard

Our Smart Dashboard is your central hub for real-time insights and data visualization. It provides a user-friendly interface for monitoring and managing various aspects of your investments, startups, and portfolio performance

Artificial Intelligence

Experience the power of Artificial Intelligence in your investment decisions. Our AI-driven algorithms analyze data and trends to help you make informed choices and optimize your portfolio for maximum returns

Finance

Stay in control of your financial investments with our comprehensive finance tools. We offer secure transaction processing, portfolio management, and investment tracking, all designed to enhance your financial well-being

Forecasting Reports

Unlock the future of your investments with our Forecasting Reports. Our data-driven reports provide predictive analytics, helping you anticipate market trends, startup performance, and financial outcomes

Big Data

Harness the potential of Big Data for your investments. We gather and analyze vast volumes of data to provide you with meaningful insights and uncover hidden opportunities within the startup ecosystem

eLearning

Continuous learning is the key to successful investing. Explore our eLearning resources, including webinars, courses, and guides, to expand your knowledge and stay up-to-date with the latest investment strategies and trends

Frequently Asked. Questions

www.capitalwix.com

Startup investing involves providing capital to early-stage companies in exchange for equity or ownership stakes. It works by selecting promising startups, making an investment, and potentially earning returns as the company grows and succeeds.

Startup investments can offer significant returns compared to traditional investments. They also allow you to support innovation and emerging industries while diversifying your investment portfolio.

We focus on a wide range of emerging industries and technologies, including but not limited to artificial intelligence, biotechnology, clean energy, fintech, and more.

To get started, sign up on our platform, complete the necessary documentation, and browse through our list of available startups. You can choose the ones that align with your investment goals.

The process includes signing up, selecting a startup, completing the necessary investment forms, transferring the funds, and tracking your investment through our platform.

Startup investments carry risks such as potential loss of capital, market volatility, and the uncertainty of startup success. Diversification and due diligence can help mitigate these risks.

We offer opportunities for both accredited and non-accredited investors, but some startups may have specific requirements. Please check each investment opportunity for details.

Yes, we offer resources, guides, and customer support to help new investors understand the process and make informed decisions.

We employ a rigorous selection process that includes screening for potential, market demand, the team’s expertise, and more. Startups must meet certain criteria to be listed on our platform.

The timeframe for returns can vary widely, but most startup investments are considered long-term. It may take several years before you see significant returns.

Yes, there may be fees and commissions associated with investments. The details can be found in the terms and conditions for each investment opportunity.

Absolutely! Diversification is a recommended strategy. You can invest in startups from various industries to spread risk and potentially enhance returns.

We conduct thorough due diligence, which includes evaluating the business model, financials, team background, market analysis, and other factors to assess the startup’s potential.

We provide regular updates on your investments through our platform. You can also expect updates from the startups themselves, including financial reports and performance metrics.